|

【Editorial note】In 2023, State-owned Assets Supervision and Administration Commission of the State Council optimized the central enterprise operation indicator system to "one profit and five ratios", which includes total profit, asset liability ratio, operating cash ratio, return on net assets, R&D investment intensity, and overall labor productivity. Hargent Research Institute and China Construction Enterprise Management Association compiled and published the "Research Report on Finance and Taxation of Listed Companies in the Chinese Construction Industry", which analyzes the trend and characteristics of the "one profit and five ratios" of listed construction enterprises in the past four years from the perspectives of overall situation, key detailed industries, and leading enterprises (top 20 enterprises in terms of operating income). This article is an analysis of return on net assets. |

01

整體(tǐ)情況

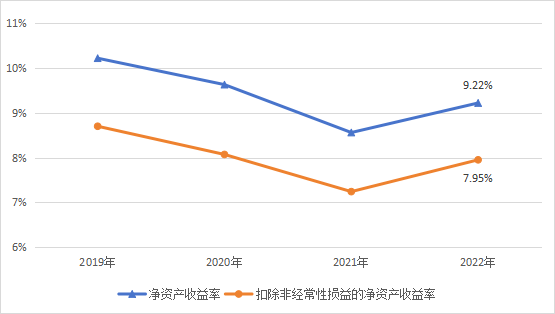

2019年至2022年,建築業上市公司的淨資(zī)産收益率整體(tǐ)呈先降後升趨勢。受經濟下(xià)行、行業盈利能力下(xià)降影響,前三年下(xià)降至8.56%,2022年上升至9.22%,扣除非經常性損益的淨資(zī)産收益率上升至7.95%,盈利能力有所提升。近年來,建築企業根據市場發展需求,不斷優化和調整産業鏈,有效降低企業成本開(kāi)支,提高資(zī)源利用效率,積極應對宏觀環境帶來的負面影響,盈利能力穩定。(見下(xià)圖)

02

重點行業情況

03

二十強企業情況

左右滑動查看更多

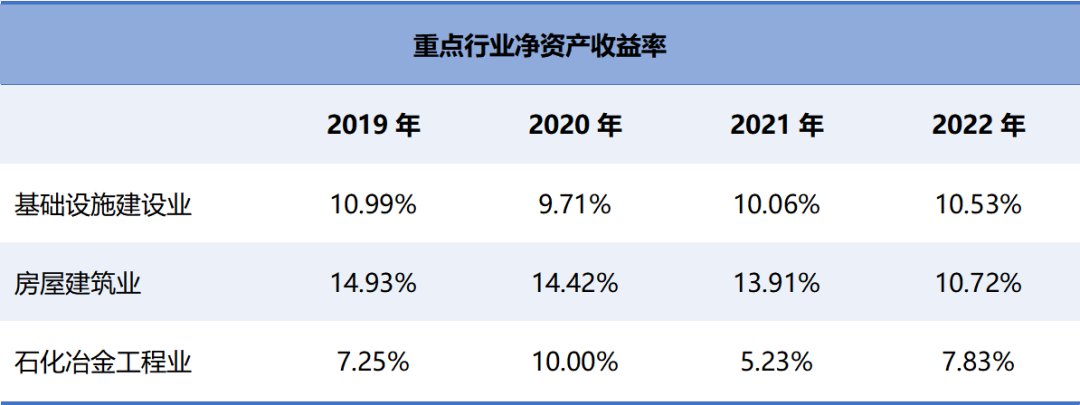

《中(zhōng)國建築業上市公司财稅研究報告》已連續發布六年,2023版報告以126家建築業上市公司公開(kāi)的财務信息數據爲基礎,收集近四年469份年報、18000多條基礎數據,對2019年至2022年建築業上市公司财稅情況按明細行業進行分(fēn)類,選取基礎設施建設、房屋建築、石化冶金工(gōng)程爲重點行業,分(fēn)析行業内企業的财務指标和納稅指标的變動趨勢及影響,同時特别分(fēn)析了營收二十強企業的各項指标,突出展示了重點明細行業、行業龍頭企業财務和稅務情況的走勢與特征。報告的付梓,客觀反映了行業上市公司财務和納稅實際情況,有助于該行業企業對照同行,總結企業财稅管理的得失,爲行業内企業、稅務機關、行業協會等各利益相關者評價納稅人稅負變化,提供了周期完整、高度可比、專業可信的參照系,樹(shù)立了稅務專業服務組織開(kāi)展分(fēn)行業上市公司财稅研究的典範。

An Analysis of the Impact of the Four Major Changes in the New “Company Law” on Corporate Tax Management

2024-01-25read:170second

As the Country Regulates the Implementation of the New PPP Mechanism, What Are the Key Points in Tax Management?

2024-01-25read:155second

Transportation Expense Reimbursement and Deduction of Input Tax, These Precautions Must Be Understood!

2024-01-12read:181second

This website uses cookies to ensure you get the best experience on our website.