New policies have been released to help struggling businesses in the service industry. Homeowners who received reduced or waived rent may be eligible for tax reductions or exemptions in 2022 if they can show financial hardship. Local authorities should implement these regulations as needed.

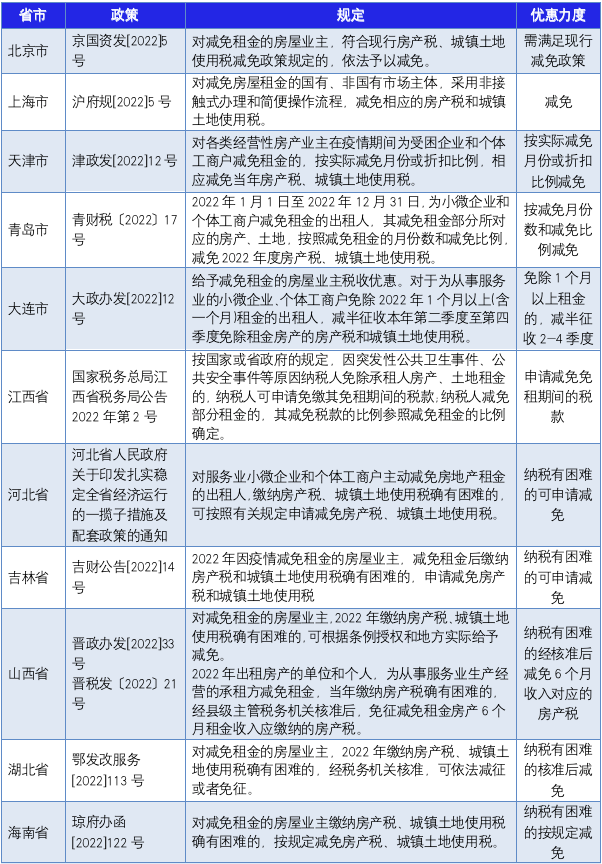

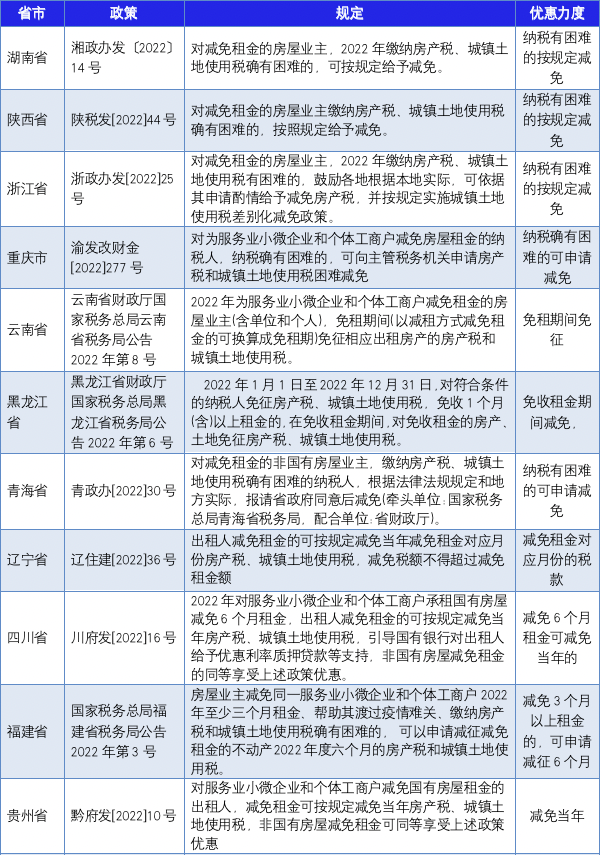

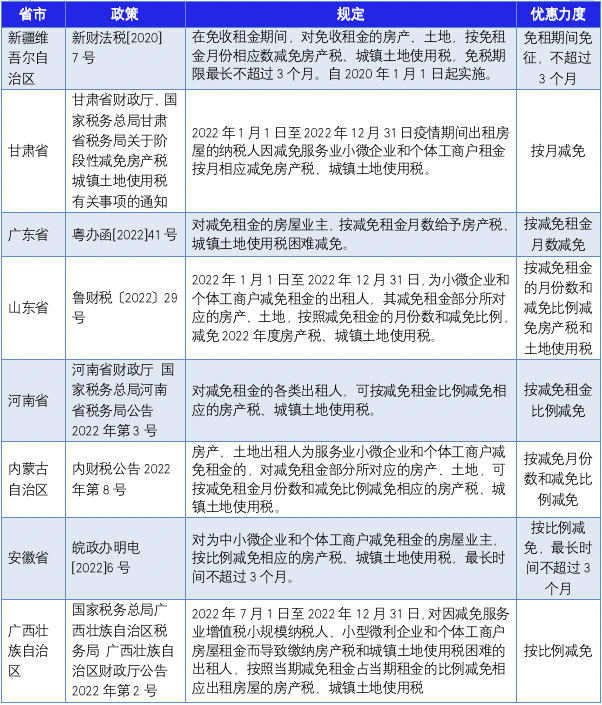

信心大(dà)增!2022年新冠疫情期間各地對減免租金的房産稅、城鎮土地使用稅優惠

爲幫助服務業領域困難行業渡過難關、恢複發展,國家發展改革委 财政部、稅務總局等印發《關于促進服務業領域困難行業恢複發展的若幹政策》的通知(zhī)(發改财金〔2022〕271号)。其中(zhōng),對減免租金的房屋業主,2022年繳納房産稅、城鎮土地使用稅确有困難的,鼓勵各地可根據條例授權和地方實際給予減免。

爲了減輕減免租金的房屋業主的負擔,大(dà)部分(fēn)省市的政府部門或稅務局陸續出台了房産稅和城鎮土地使用稅減免稅規定,華政小(xiǎo)編搜集整理了相關政策,對減免标準大(dà)緻歸納總結以下(xià)四類:

1.上表中(zhōng)部分(fēn)省市出台了稅務文件,大(dà)部分(fēn)省市是政府出台的文件,具體(tǐ)執行中(zhōng)還需了解當地稅務機關的具體(tǐ)執行尺度哦。

2.關于減免租金的相關會計處理,請參考以下(xià)三個文件:

(1)《新冠肺炎疫情相關租金減讓會計處理規定》(财會[2020]10号)

(2)《财政部關于調整<新冠肺炎疫情相關租金減讓會計處理規定>适用範圍的通知(zhī)》(财會[2021]9号)

(3)《财政部關于适用<新冠肺炎疫情相關租金減讓會計處理規定>相關問題的通知(zhī)》(财會[2022]13号)

An Analysis of the Impact of the Four Major Changes in the New “Company Law” on Corporate Tax Management

2024-01-25read:170second

As the Country Regulates the Implementation of the New PPP Mechanism, What Are the Key Points in Tax Management?

2024-01-25read:155second

Transportation Expense Reimbursement and Deduction of Input Tax, These Precautions Must Be Understood!

2024-01-12read:181second

This website uses cookies to ensure you get the best experience on our website.